Since the war in Ukraine began, its effects on the financial and energy markets have dominated the financial news. I decided to send this quick newsletter update to address some common concerns.

1. First, some perspective: The stock market has actually been mostly flat since Russia invaded the Ukraine on February 24th. Much of the market decline you have heard about in the news occurred prior to the invasion (due to concern of rising interest rates).

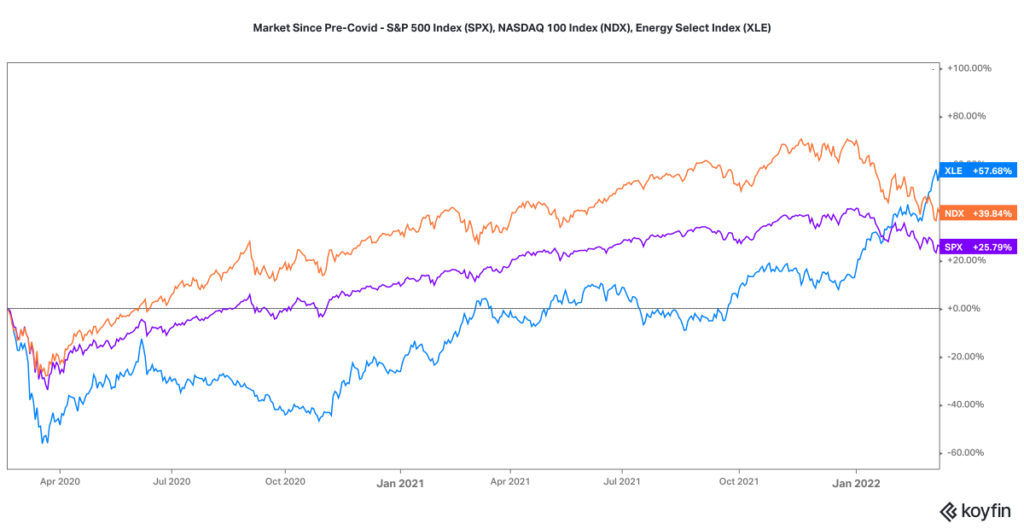

While the market is down from its high point at the end of 2021, it is still up significantly since the pandemic began.

The S&P500 index is still 25% higher than it was on the highest day before the pandemic started.The NASDAQ is 38% higher than it was on the highest day prior to the pandemic.In my view, segments of the stock market approached irrational valuations at the end of 2021, and we have since experienced a bit of a cooling off. While there are areas of opportunity, some segments of the market, in fact, are still expensive.

2. I have received a few questions about accumulating more cash during the uncertainty caused by the Ukraine invasion. Warren Buffett once said to never hold cash during a war. Considering he purchased his first stock in 1942, I consider him to be an authority on the subject.

Buffett explains how times of war are also times of high inflation and you are often better off in the long run by owning shares in companies that remain productive, rather than sitting in cash and losing purchasing power. (I should add, of course, that this does not apply to your short-term reserves, which should always be in cash).

3. Energy prices are likely to wane later in the year as production elsewhere increases to replace the lost Russian production. This can manifest from more domestic production, China (or India) choosing to buy more Russian oil (decreasing their consumption of OPEC oil), or oil coming online from currently sanctioned countries (Iran, Venezuela). *Since writing the first draft of this newsletter, oil prices have dropped from nearly $130 per barrel to under $95. Refined gasoline has dropped almost a dollar per gallon, although this has not shown up in retail pricing just yet.*

We are very fortunate to live in the United States where we can be self-sufficient in both food and energy production. The rest of the world will have a much tougher go at this.