Less than a month ago, the markets were hitting new highs as positive economic data indicated that the US economy was continuing to grow. Then Coronavirus took a foothold in Europe and the United States. Fear-driven headlines and uncertainty caused the markets to plunge and behave erratically since.

However, despite the headline negativity, there is much reason to believe that we will get past this.

Despite the many blunders of our government, our private sector rose to the occasion with incredible speed. Moderna began working on a vaccine over two months ago, when Covid19 was in few American minds. This vaccine is currently in the testing process. Gilead is working on repurposing Remdesivir, a drug originally developed for Ebola that has shown some promise in treating those already infected with Coronavirus. It is without a doubt that many other companies and institutions here and abroad are working on solutions as well.

While health and interruption to daily life are the primary concerns, many people are rightly wondering the effect this will have on their investment portfolios. There are many things to consider here.

First, there is no reward without taking risk. Historically, “safe” investments have lagged the inflation rate, eroding the purchasing power of the principal over time. Risk must be taken in order to generate a return, and a diversified portfolio must be constructed while keeping in mind that sell-offs will likely happen over the life of the investment portfolio. We are in one such sell-off… this is the pain we must endure to earn our gain.

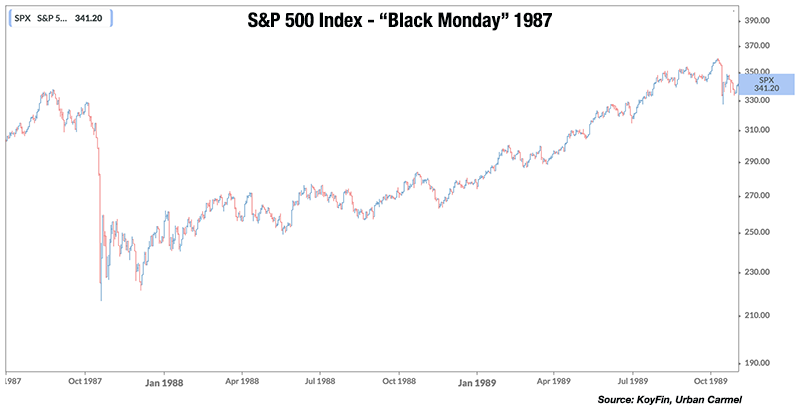

Historically, we have seen many large pull backs in the market over the years… the Great Financial Crisis in 2008/2009, the dot com bubble, the crash of 1987, and many before. In hindsight, these always looked like good buying opportunities. However, during each of those episodes fear and panic gripped investors as they asked themselves “what if it’s different this time?”

Fortunately, this situation isn’t like the Great Financial Crisis (GFC). During the GFC, our system was fundamentally broken and failed… to which the markets responded dramatically. That is not the case here. The markets are responding to the uncertainty and fear caused by Coronavirus. The underlying fundamentals of the economy were strong.

Perhaps the only modern comparable that we can use is “Black Monday” in 1987, where the S&P 500 fell 20% in one day, then rose 15% the next two days, and then returned to the low the next week. It rose 15% again then sunk near the original low 6 weeks later. The S&P 500 was once again setting new highs less than two years later.

“Should I try to time this?”

During a big sell-off, there is a temptation to attempt to time the market… by either selling before things get bad (or worse) or by trying to time the bottom to buy in. The problem with this is that it is incredibly difficult (if not impossible) to time the market with any regularity. Even if you managed to be lucky enough to sell before things got bad, it is even more difficult to figure out when to buy back in. As Jeremy Grantham once said, “be aware that the market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before.” By the time you have spotted a recovery, you will likely have already missed it.