When everyone knows the playbook, the plays stop working. That seems to be the case for everyone who has dusted off their playbooks from the Great Financial Crisis and are trying to make sense about what is happening in 2020.

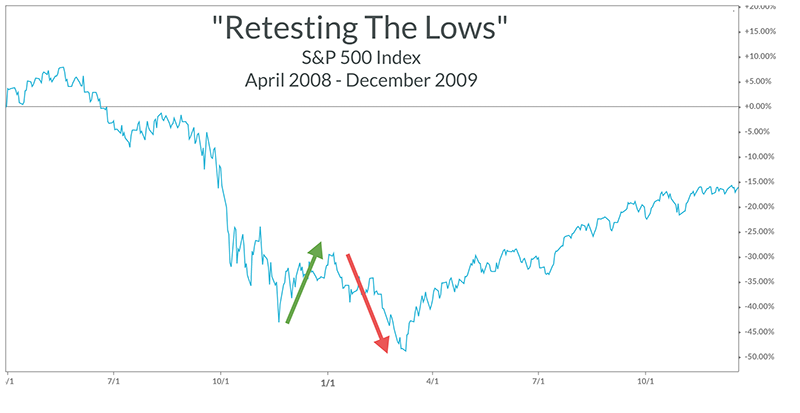

The S&P 500 has increased 27% from the March 23rd lows at the time of this writing. Such a sharp snap back has many people expecting a “retest of the lows” like we have experienced in prior crashes. However, when everyone expects something to happen in the markets, it paradoxically tends to decrease the likelihood of it happening.

Also, unlike prior crises, fiscal and monetary stimulus has been both swift and substantial. Does that mean we won’t have another leg down? No, but it does not mean we should expect one either. While it is reasonable for stocks to go lower than where they are today, it’s also foolish to expect that stocks will hit the March 23rd lows again just because such movement occurred in prior crashes.

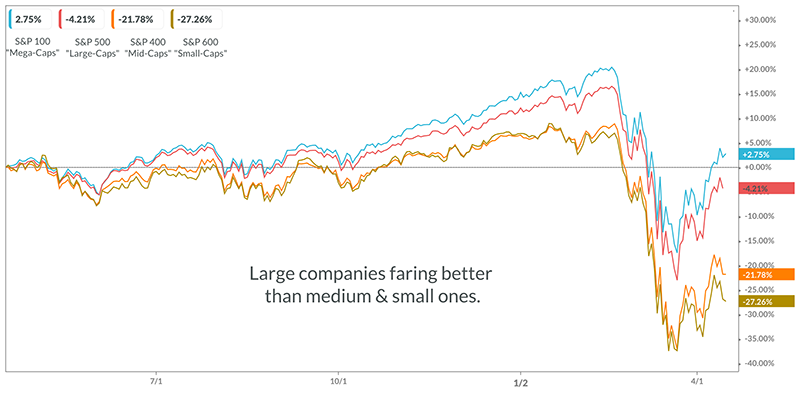

It’s also worth noting that large companies are faring a lot better than small ones. For the past year, the 100 largest companies measured by the S&P 100 are actually up +2.75%, while the medium (S&P 400) and small companies (S&P 600) are down -21.78% and -27.26% respectively.

This is reflective of the fact that our economy was very strong before getting hit with the external shock of COVID19. Large companies are expected to have the balance sheets to carry though the shutdown, while there is less certainty with smaller companies.

So what does all of this mean? It means that it is important now as ever to have a diversified investment portfolio. You wouldn’t be human if you didn’t feel a bit of fear or anxiety during a time like this. However, diversified investors that have stood fast in a crisis have historically been rewarded.