Since headlines of “new market highs” have been in the news, I have fielded many questions and concerns about how the market can be setting new highs (the S&P500 was down over 30% in March! It seems so long ago…) while we are in a pandemic induced recession where things have not yet returned to normal. There are quite a few factors driving this.

First, the market selloff wasn’t caused by a systemic issue with the economy. The economy was roaring in February and was shocked by both national and international shutdowns due to the pandemic.

Additionally, our economy is more resilient to a pandemic than it has been in the past. Much of our society is able to work from home and we are less reliant on manufacturing, which translates to less production loss.

Finally, households themselves were better positioned to weather a recession with lower debt and mortgage payments in relation to income than at any other period in recent history. This comfortable household position was then turbo charged by the massive federal stimulus response…

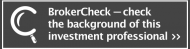

This chart shows the billions of dollars in personal savings (annualized). You can see the massive… and I mean MASSIVE… spike in personal savings in April when the government began to rollout stimulus checks, increased unemployment payments, PPP loans, etc. Two months later in June, the amount of personal savings is still significantly above the historical average.

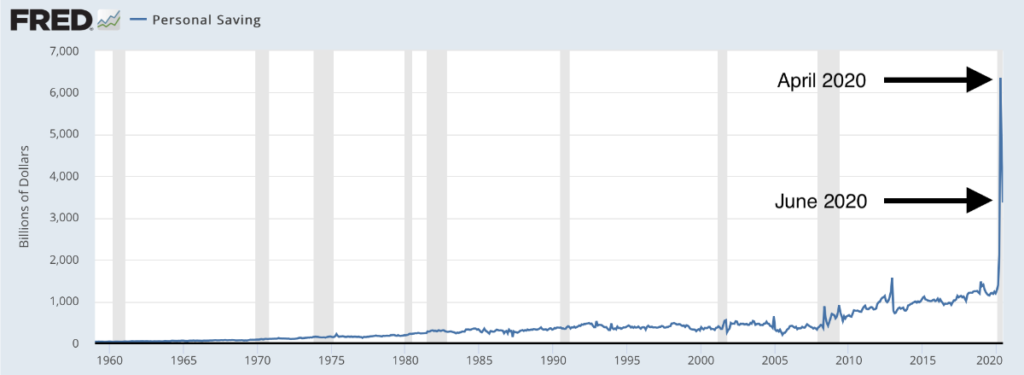

This chart shows “total checkable deposits” which further illustrates the massive amounts of cash that are on hand – injected by the government to prevent the economy from plunging into despair.

What does this have to do with the stock market setting new highs? Some of this money is finding its way into the stock market and pushing up prices. More importantly, however, the stock market is forward looking… and it is looking forward to when the lockdowns are over and the mighty American consumer deploys this money back into the economy. Companies will benefit in the form of increased revenue, which will justify a recovery in the stock market.